About Us

Welcome to CASH Algo Trading Challenge 2023.

Ideate your trading algorithms, test on a robust back-testing platform, and compete to make a name for yourself! Gain professional industry knowledge and practical skills to prepare yourself as the next-gen algo-trading professional.

This Challenge is open to public. Create teams of 1~4 members with diverse skills (maths, statistics, finance, coding, presentation) and register by 22 May 2023.

1st Round:

Ideate

Registered teams of 1-4 members will prepare a ppt less than 15 slides consisting of:

• Executive summary

• Trading idea description

• Trading logic

• Implementation detail

• Team biography

Coding is not required in this round

Submission deadline: 29 May 2023

Result announced: 31 May 2023

2nd Round:

Test

Teams will code their trading algorithm and test on our back-testing engine, then submit the code

Judges will backtest trading algorithms for return, volatility, robustness and practicality to select advancing teams

Submission deadline: 28 Jun 2023

Result announced: 30 Jun 2023

Final Round:

Compete

Each team needs to compete in out-sample forward test and live paper trading

Live paper trading will last for 2 months from 3-Jul-2023 to 31-Aug-2023

Teams will present trading plan to judges in a 5-minute pitch session in Finale

Judges will select winners in each of these categories:

• Best Return

• Best Sharpe

• Best Strategy Design

Finale: 10 Sep 2023

Parties

Diamond Sponsors:

Gold Sponsors:

Silver Sponsors:

Supporting Organisations:

Participating Universities:

Technology Sponsors:

Result

The final result of the CASH Algo Trading Challenge 2023 (Global)

Best Return: live trading period 1/7/2023 - 31/8/2023

Best Sharpe: out-sample forward test 1/3/2022 - 31/5/2022

Overall Champion: MASS (Hong Kong)

Leaderboard

Live paper trading 3-Jul to 31-Aug-2023

Schedule

Awards

There are 3 award categories: (A) Best Return, (B) Best Sharpe, and (C) Best Strategy Design.

The winning teams from each category will be entitled to:

Cash Prize

• Grand prize: US$8,000

Best Return/Sharpe/Strategy Design

• 1st place: US$1,000 each

• 2nd place: US$600 each

Employment Contract

All prize winners may have a chance to receive an employment contract worth US$100,000 from CASH Algo

Free Subscription of Back-testing Engine

All prize winners will get 1-year free subscription of our back-testing platform

Join Algo Challenge Association (ACA)

All prize winners will connect with algo fund managers and industrial professionals in Algo Challenge Association (ACA)

Resources

The dataset provided includes the historical trading records of Hong Kong equity market in past years. Kindly note that the data provided is strictly for trading strategy prototyping purposes only. Final round evaluations will be carried out using a new data set with the same structure but from a different time period. Thus, over-fitting of the data set is discouraged.

Datasets

Provide access to required historical data for model development and testing

• Market data

• News

• Economic Statistics

System

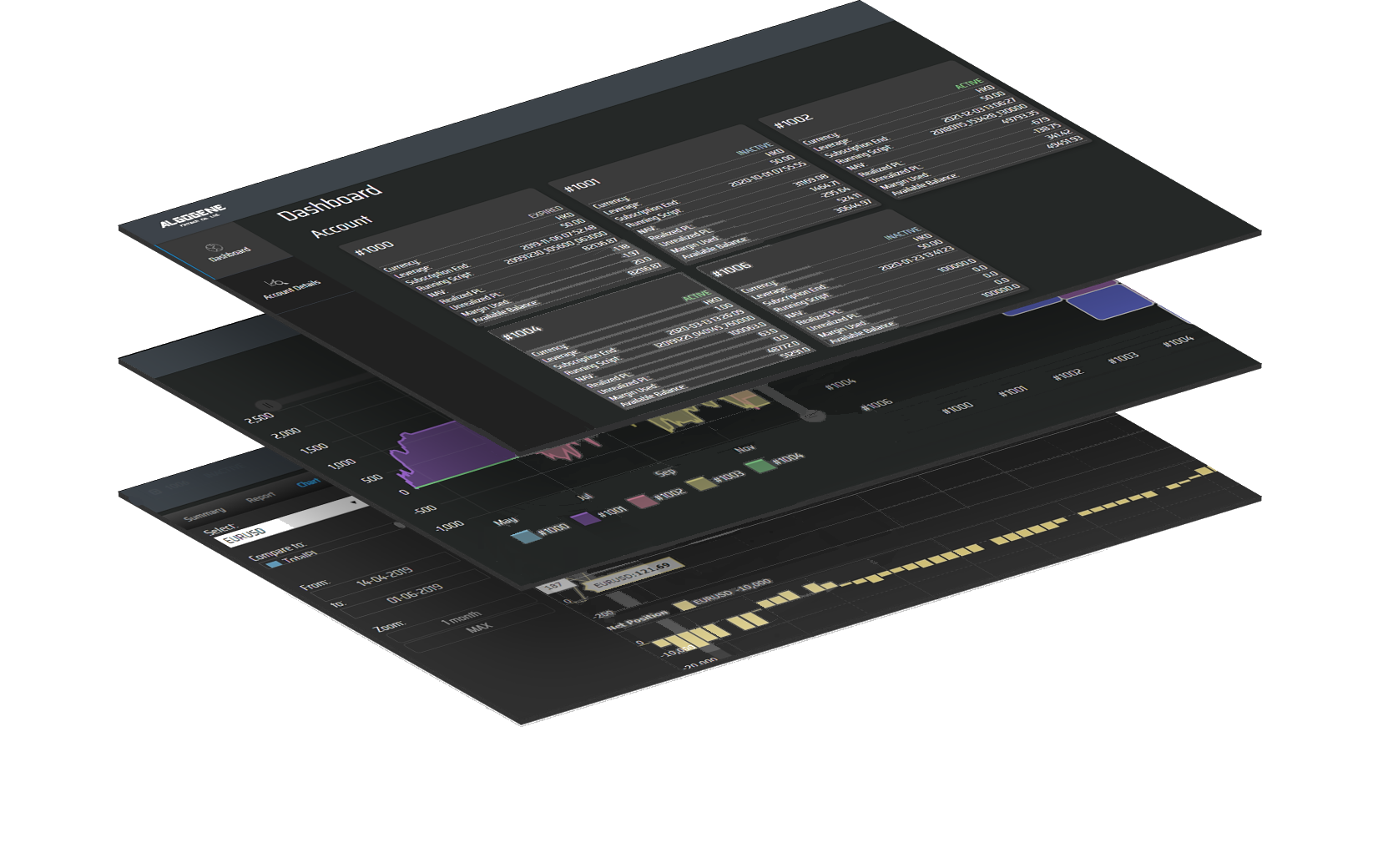

• Access to our back-testing engine, cloud simulation environment and relevant technical documents

• OpenAI ChatGPT 3.5 embeded in engine to copilot and assist your coding

Tutorial Clip: A Beginner Guide to Build Algorithmic Trading Strategies

Sample Screenshot: Copilot with OpenAI ChatGPT3.5 to assist your coding

Judging Criteria

Judging panel criteria comprises team performance (30%), trading strategy (30%), and presentation (10%), plus the risk-adjusted return (30%) as computed by our back-test system.

(A) Best Return

A good return is the primary goal of every algo trading strategy. Our state-of-the-art trading system will back-test the trading strategies of Finale teams to ascertain outcomes. The team with the highest out-sample 1-year forward test and 2-month live paper trading return will win this award.

(B) Best Sharpe

A good strategy does not only need to be profitable, but it is also important to take care of the risk taking. The team with the highest Sharpe will win this award.

(C) Best Strategy Design

Recognises Finale participants' knowledge and skills in developing the best algo trading strategy that demonstrated the following:

• Trading Strategy Logic: reasonable return, manageable risk, stability and predictability;

• Creativity: innovative use of statistical models, parameters, forecasting methodology or interpretation of data and novel ideas based on existing theory and models; and

• Execution Potential: a realistic strategy and full consideration of factors including capital, trading time, market impact and risk management.

Rules

- This Challenge is open to public.

- Each individual contestant is only allowed to be in one team.

- Each team must elect one representative to liaise with the organisers.

- All entries must be the original work of the contestant team. Any form of plagiarism is prohibited and the contestant team will be disqualified from the Challenge.

- Each individual contestant is required to sign a Non-Disclosure Agreement with the organisers.

- Finalists must present valid ID cards and provide a copy for verification.

- The judging panel’s decision of the Challenge results is final. The organisers reserve the right to the final decision in all other areas.

- An online briefing session will be arranged after registration period to answer any inquiries about the Challenge.

FAQ

Q: If a person is in overseas, can he still join the competition via zoom?

A: Overseas participants are still able to join the Finale via Zoom, though the Finale will be held phyiscally in Hong Kong. The Finale and award presentation is on 10 Sep 2023.

About CASH Algo

Built upon the technology-focused heritage of CASH Group (SEHK: 1049), CASH Algo Finance Group (CAFG) is a pioneer in quantitative finance and algo trading based in Hong Kong. CAFG marries expertise in financial markets with technology innovation, engaging leading-edge FinTech to create superior and sustainable value for investors. We launched our first algo trading strategy in 2009 and have since expanded into multiple strategies and tactics covering all the major markets. In 2017, we introduced quant funds to provide asset management services to institutional clients, funds, and high-net-worth individuals.

As a pioneer in quantitative finance and algo trading in Asia, we understand the importance of a low-latency platform integrated with a robust real-time risk management system. In addition to serving existing strategies in multiple markets with our proprietary and scalable platform, CAFG is expanding its trading strategies to new markets with cutting-edge algorithmic technologies to optimise risk-adjusted returns across a broad range of asset classes.

We also provide an algo incubation service to assist algo traders, quant strategists, and academia dedicated to researching, developing, testing, and launching their trading ideas. CAFG has established a proprietary one-stop platform for the entire investment lifecycle, supporting data analytics, strategy deployment, smart execution, and robust risk management.